open-end credit meaning and example

However by establishing an open-end credit account with a limit of at least 500 the consumer would save the additional 159 annually in premiums assuming no transaction costs to. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently.

Ppt 12 1 Installment Loans And Closed End Credit Powerpoint Presentation Id 395602

Open-end credit is not restricted to a specific.

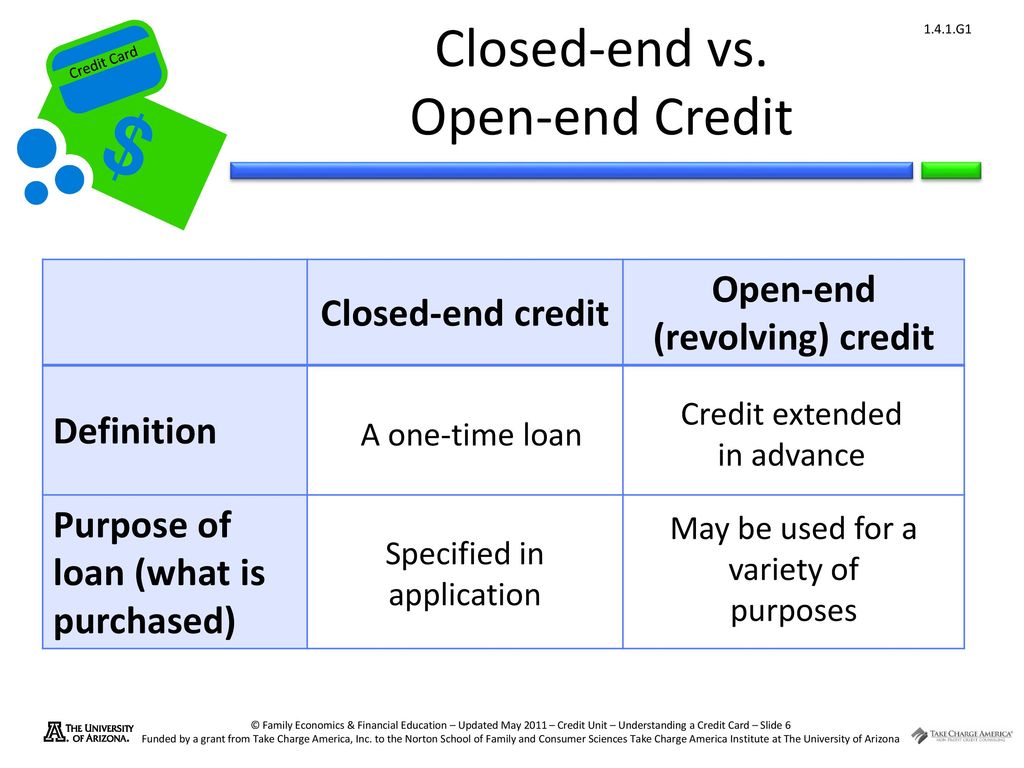

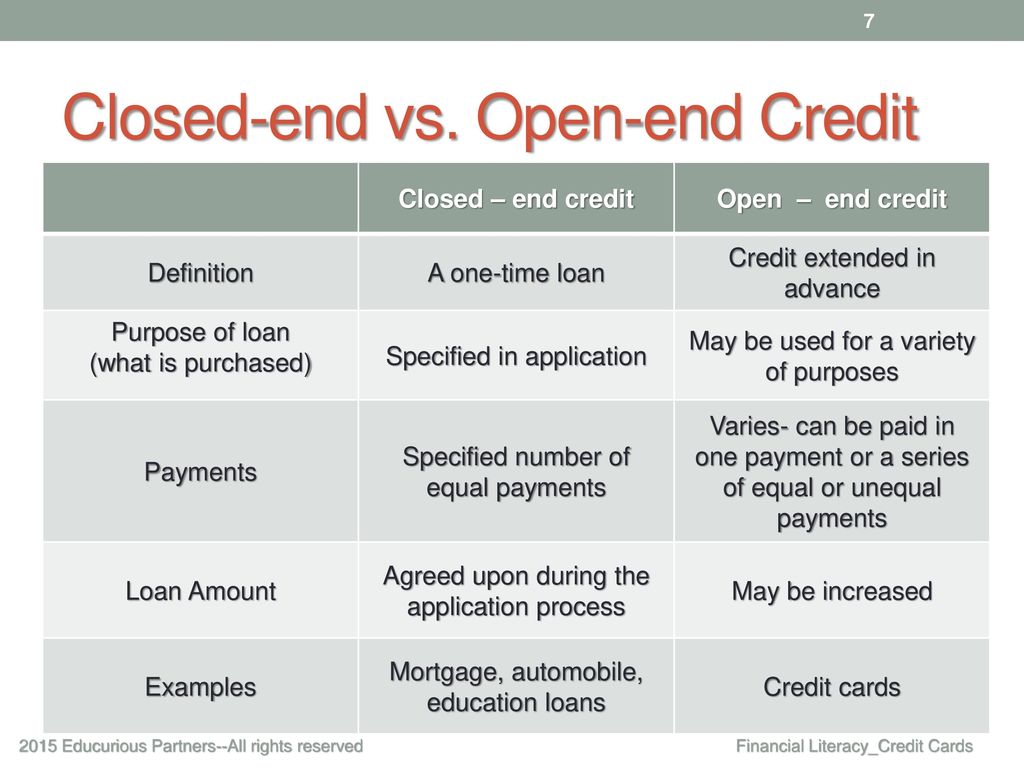

. Open-end credit also called revolving credit can be defined as a line of credit that gives the borrower a certain limit of credit and the ability to frequently borrow as little or as. A closed-end loan on the. Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time.

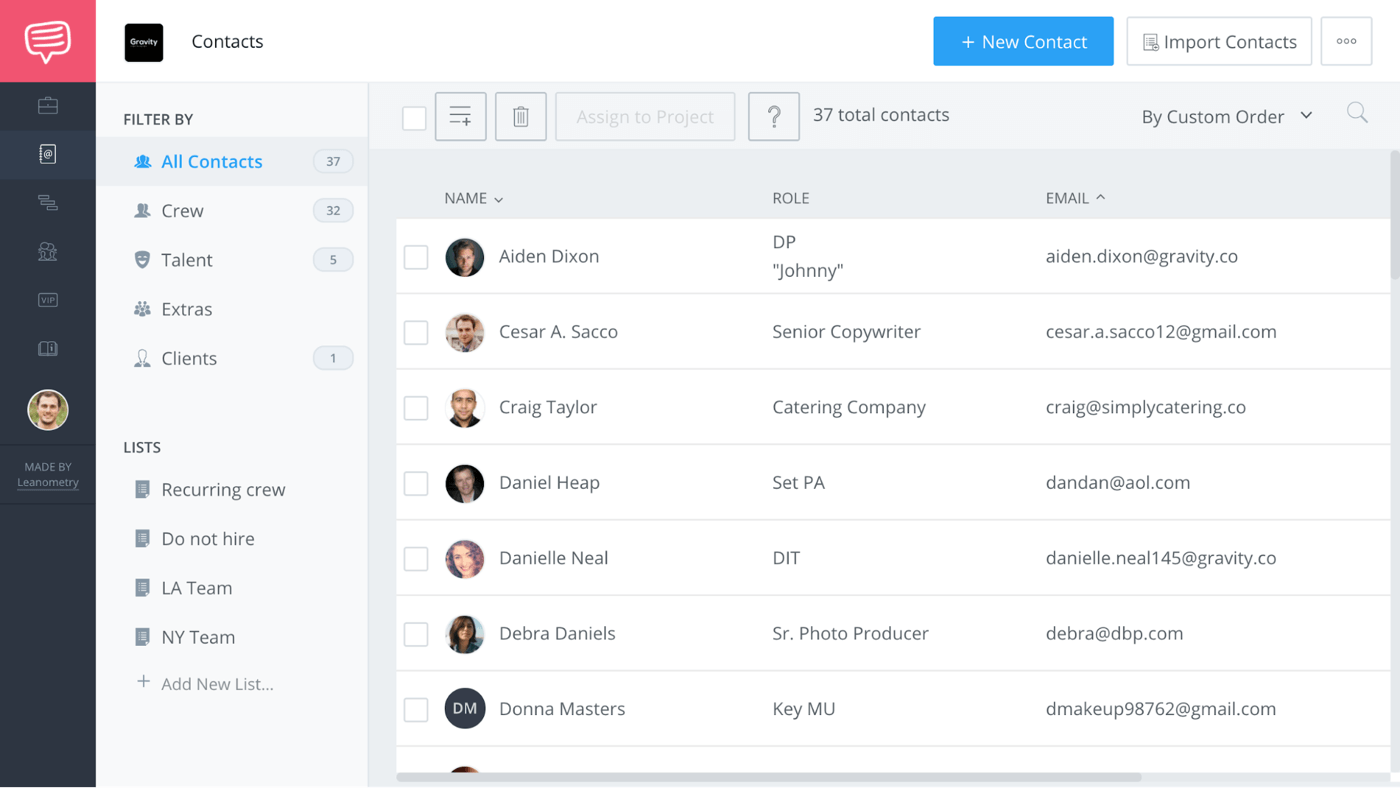

Open-end credit also i See more. For instance you could have a credit card for 10. Open-end credit is not.

Credit cards and other revolving accounts are unsecured. Open-end credit is a form of credit where the lender extends credit facility to the borrower who can repeatedly use the funds to a certain specified limit. Meaning of Open-End Loan.

Advantages of Open Credit. The most common example of this is a credit card. A credit card is another great example of an open end loan this time it can be either secured or an open-end unsecured loan.

Consumer credit limits can add to a predetermined credit limit or be paid immediately at any time. One of the reasons why an open-end credit is preferred is that it makes money available to borrowers if and when it is needed. The open-end loan is a revolving line of credit issued by a lender or financial institution.

An open-end loan is. The preapproved amount will be set out in the agreement between the lender and the borrower. If the credit card agreement does not require.

Open-ended credit lines are paid monthly for as long as you have the credit and an outstanding balance. An open-end credit solves this difficulty by making credit available for usage as and when needed rather than expecting the borrower to complete repayments by a fixed date. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments.

Revolving credit is sometimes referred to as open-end credit. An open-end loan is a preapproved loan between a financial institution and a borrower that can be used repeatedly up to a certain limit and then. A loan can be of two types.

Open-end credit is a preapproved loan between a financial institutionand borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments coming due. Customers have the right to choose the current balance without being punished paying. Closed-end loans are structured similarly to traditional mortgages with all funds given at the loan signing and fixed monthly payments made to the lender.

What Are Interest Rates How Does Interest Work Credit Org

How To Use A Credit Card Best Practices Explained Valuepenguin

What Is A Good Credit Score Credit Score Ranges Explained

The Ultimate Guide To Film Credits Order Hierarchy With Template

Difference Between Open End Credit And Closed End Credit

Understanding A Credit Card Ppt Download

Introduction To Credit Personal Finance What Is Credit Money Borrowed To Buy Something Now With The Agreement To Pay Later Ppt Download

Sales Journal Entry Cash And Credit Entries For Both Goods And Services

The Ultimate Guide To Film Credits Order Hierarchy With Template

Loan Vs Mortgage Difference And Comparison Diffen

Understanding Credit Cards Ppt Download

Difference Between Open End Credit And Closed End Credit

How To Order Movie Credits Guide To Opening And End Credits 2022 Masterclass

Shapes Definition With Examples Splashlearn

Massive Open Online Course Wikipedia

What Happens If You Only Pay The Minimum On Your Credit Card

:max_bytes(150000):strip_icc()/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)